Brand new financing to increase monetary addition additionally the hydropower business portray the original lead expenditures on Himalayan country from the several Nordic creativity banking institutions.

Finnfund and Swedfund are making finance from $10m (9.26m) for every single so you can Kathmandu-situated Siddhartha Financial to support small, smaller than average medium people (MSMEs), farming additionally the hydropower industry.

Siddhartha Bank is just one of the country’s largest commercial banks which have 196 twigs all over the country. The mortgage collection totals $step one.55bn layer a variety of monetary activities, plus development, general and you can shopping.

At the very least 30% out of financing proceeds from this new fund can be spent on feminine, when you look at the help gender equality and you can ladies empowerment. Around forty% of one’s bank’s clients are women also it has the benefit of products directed on the feminine entrepreneurs.

The brand new DFIs said they’d in addition to support Siddhartha Financial for the development its internal techniques related to ecological and you can social products as well as on minimization from weather threats and you can has an effect on about their activities.

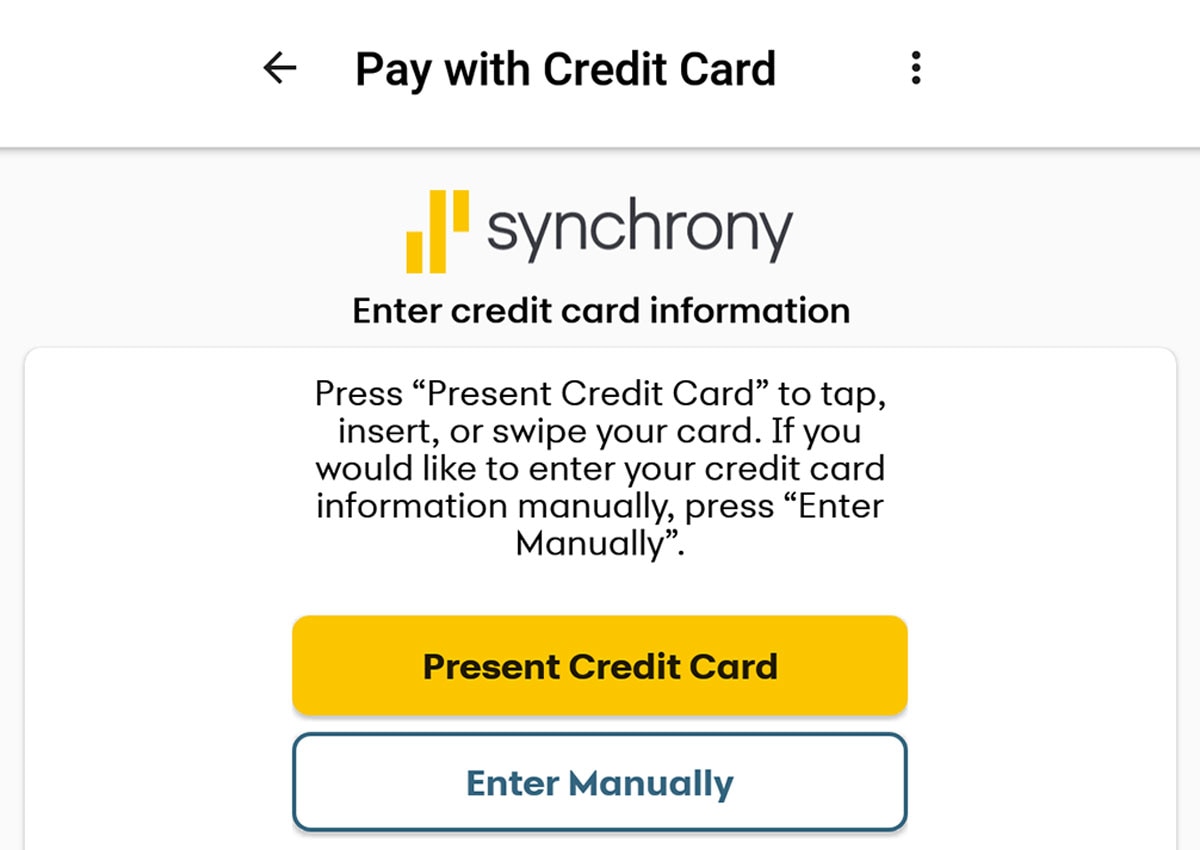

Siddhartha Lender furthers financial introduction from the looking to focus people certainly one of the many Nepalis staying in secluded portion that will be currently unbanked. The method has been facilitated from the development digital an internet-based choice for consumers.

Discover limited accessibility a lot of time-title funding inside the Nepal and you will, once the a news financing organization, we are able to including further boost Siddhartha Bank’s environment and you will social governance, along with effect performs, that renders which financial support crucial, Jane Niedra, capital director monetary inclusion at the Swedfund, said.

Nepal is designed to become a middle-money nation by 2030 and you will a developed nation by 2043. However,, as savings might have been growing recently, increased by the tourist, agricultural yields and you can better accessibility electricity, it remains sensitive.

Most companies joined from inside the Nepal is MSMEs, putting some market an important pillar of your cost savings. However, accessibility financial credit remains restricted and needs to switch, considering Ulla-Maija Rantapuska, Finnfund’s older resource manager.

A separate issue to own Nepal’s creativity would be the fact hydropower prospective requires money. As a result of all of our resource, Siddhartha Financial is now able to grow their mortgage profile when it comes to those groups, she told you.

Siddhartha Lender furthers economic inclusion by trying focus customers certainly one of the many Nepalis located in secluded parts which can be currently unbanked | Images from the Kalle Kortelainen into the Unsplash

Brand new Himalayan kingdom’s large hydropower information have the opportunity not merely to help with financial extension inside the nation, and in addition to create beneficial export income owing to conversion so you’re able to neighbouring nations, rather India.

Doing a 5th of one’s state’s inhabitants of 29 million was in fact lifestyle below the national impoverishment line inside 2022, which have higher poverty account inside the outlying components, centered on Community Bank investigation

Nepal already enjoys almost 3 gigawatts (GW)regarding electricity age group capability, more than ninety% of it of hydropower. The government was desperate to attract foreign funding on industry away from China and further afield to assist they get to a goal out-of increasing capability to 28GW across the next ten years. A current authorities-accredited statement estimated Nepal encountered the possibility to create more than 70GW regarding electricity across 10 river sinks, although it is impractical that all that could be tapped.

Tom Gocher, President out of Nepal-concentrated Dolma Funds Administration, told Feeling Trader when you look at the 2023 that the Indian states bordering new nation and you may close Bangladesh where you can find specific 600 billion individuals you’ll would huge need for Nepalese hydropower should your age group and transmission infrastructure are going to be financed and you can created.

Both Swedfund and you will Finnfund have purchased Nepal via financing addressed by the Dolma, that has a lengthy history of private equity funding in the the country and has and additionally drawn a great many other DFI backers.

Into the 2019, a global Fund Business-led consortium create an excellent https://cashadvanceamerica.net/installment-loans-ga/ $453m financial obligation resource package to fund an effective 216-megawatt work on-of-the-lake hydroelectric plant into the Trishuli River, 70 kilometers northern out of Kathmandu. British Capital In the world (BII), Dutch DFI FMO and you can France’s Proparco were part of the money class toward project, also known as Top-Trishuli-step one, which was the biggest unmarried foreign investment in the united states on the time.

The project, that is on account of getting finished towards the end away from 2026, can give most of their annual output for the dead year, when it is most requisite.