To invest in a home is a big life event. To make sure you initiate your own travels on the right feet, we’ve got build two things you will need to do just before your step in the earliest open household.

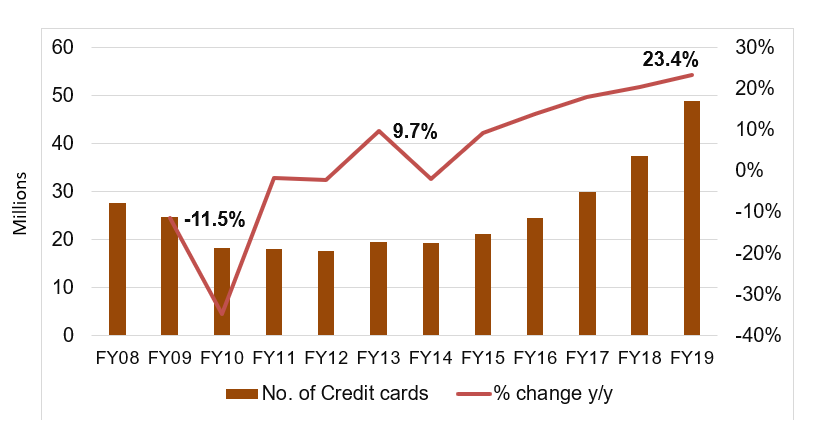

Evaluate and you may replace your borrowing from the bank scoreYour credit rating (sometimes titled good FICO get) might be utilized by their mortgage company to determine whenever you are entitled to discovered financing and you may, whenever you are, the rate you get. Scores start around three hundred and you may 850 the better the rating, the greater. It isn’t impractical to buy property, however, you are going to struggle. Understand purchasing a property with confronted credit. Generally speaking, the reduced your score, the greater advance payment your own mortgage lender need.

Check your get free-of-charge once a year during the annualcreditreport. If it is lower, you will want time for you to increase it. You can start performing the second:

It is never ever a promise of financing, but it is much better indication (for both you and the person you happen to be to buy from) that you will be stretched a loan if you make an offer towards a house

- If you don’t have a credit score, have one. Take-out a charge card to make your payments promptly to display you are borrowing-worthy. Devoid of a credit rating can provide a very low credit score.

Its never a guarantee off that loan, but it is much better indication (for both both you and the individual you are to purchase out of) that you will be lengthened a loan if one makes an offer towards a property

- If for example the credit cards is actually maxed (otherwise almost maxed) you’ll need to start investing all of them of. Playing with too much of your readily available credit is also reduce your borrowing score.

Its never ever a promise of that loan, but it is better sign (for both both you and the person you’re to shop for off) that you’ll be lengthened financing if you make a deal towards the a home

- Make ends meet punctually. In case your payments end up being 31-days past owed they likely be said into the borrowing bureau minimizing your credit rating.

In case your rating are significantly less than five-hundred, you may have what exactly is entitled confronted borrowing

Pick the place you want to liveDo we want to stay in the city, state, or county you are in? Make an effort to research the choices and make sure you know for which you desire to be for another couples age.

Contact a region financial lenderWorking with a home pro that has connections in the area is a great idea. They understand the regional and you will state earliest-time resident and you will deposit guidance programs that may save tons of money that will be in addition to most of the federal loan and you will recommendations applications. Together, you will go over their borrowing from the bank, earnings, and financial goals to discover the best mortgage.

Rescue for the off paymentThe amount you really need to conserve having a down payment utilizes the type of loan you select along with your financial situation. It does are priced between 0% of your own total purchase price having an effective Va mortgage to as the much as 20% or higher having traditional or jumbo fund. Many people mistakenly suppose you always you need 20% right down to get property, which will be just not the truth.

Some people may made a decision to set as much down as you are able to while others often place the lowest off. That is good for https://simplycashadvance.net/title-loans-ne/ you? Your loan officer may go from the pros/downsides of every condition so you’re able to decide.

Rating pre-approvedBeing pre-approved means your bank has checked your earnings, property, loans, and credit history to decide how much they’re happy in order to lend you.

Come across a real estate agent so you’re able to portray youOnce you might be an individual, representatives provides a fiduciary responsibility for your requirements. That means he could be legitimately forced to place your best interests basic. Might know what to find with a property and area, they will make it easier to discuss the cost, and they will make it easier to browse the papers and you may legal issues with and work out an offer and purchasing a home.