Content

For example, if you aren’t generating enough sales to secure a profit, you might need to adjust your sales approach or try another channel. The ultimate guide to key features in the Wise Business account that will help you to grow your business without borders. https://www.bookstime.com/ It’s easy for businesses to become preoccupied with finding new consumers. In actuality, it is our previous and existing clients who can provide us with the best return on investment. You can evaluate if you’re making enough money compared to your costs.

Embedding Payments into Software Platforms: The Revenue Driver for Long-Term Profitability – Nasdaq

Embedding Payments into Software Platforms: The Revenue Driver for Long-Term Profitability.

Posted: Tue, 06 Jun 2023 12:32:51 GMT [source]

Cash paid to a company is known as a “receipt.” It is possible to have receipts without revenue. For example, if the customer paid in advance for a service not yet https://www.bookstime.com/articles/sales-revenue-definition-and-formula rendered or undelivered goods, this activity leads to a receipt but not revenue. Gross sales minus the sales returns and allowances derives net sales revenue.

How to use our sales revenue calculator

Zach Lazzari is a freelance writer with extensive experience in startups and digital advertising. He has a diverse background with a strong presence in the digital marketing world. Zach has developed and sold multiple successful web properties and manages marketing for multiple clients in the outdoor industry.

That said, it’s most often calculated on a quarterly and/or annual basis. Sales Revenue is vital because of its comparability—it’s the top-line metric businesses can benchmark past and future performance against and use in forecasting, planning, and strategy going forward. So much so that it’s often used as the basis for calculating a business’ valuation. It’s also useful in benchmarking growth, forecasting and setting revenue targets, and making long-term strategic decisions. Let’s say a company offers a video subscription service for $8.99 a month, totaling $107.88 per year.

How do you calculate sales revenue for a service-based business?

In the past five years, we have driven $3 billion in revenue and 7.8 million leads for our clients. While your revenue can show you have much money you are bringing in, your net profit can point to any discrepancies in your operation. This becomes especially important as you scale and enter new markets. However, with Wise businesses can generate meaningful, recurring cost savings on the often unseen costs of expansion into new territories.

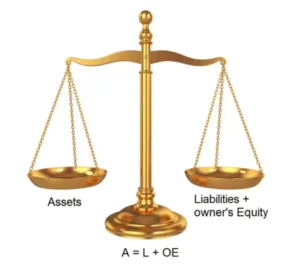

In conclusion, therefore, the sales revenue formula is generated when you multiply the price of the goods/services by the number of goods/quantity sold out or by the number of customers who bought. To calculate sales revenue on a balance sheet, use the sales revenue formula to multiply the price of each product by the quantity sold. Gross sales revenue is the income received from sales of all goods and services during a particular time period (the price per unit times the number of units sold). Net sales revenue is gross sales revenue minus any returns, discounts, or allowances.

Example of the net sales formula

Return on equity is calculated by using net income and dividing it by the shareholder’s equity (which is found by subtracting debt from assets of the company). For service revenue, say you own a carpet cleaning company specializing in commercial buildings. At the end of the month, you had about 130 clients with an average price of $1200 a service. Sales revenue is also one of the most important numbers used in forecasting. By looking at historical trends of sales revenue growth, small business owners can get a clearer picture of what the future could look like. Calculating sales income may be a straightforward procedure for you.

Minding your sales revenue will help you strengthen your core business and give attention to areas of improvement. Whether your sales are driving your income or falling short, you won’t have a full picture without calculating sales revenue. By definition, sales revenue is the money made from the successful sale of your products or services.

Calculating Product Revenue

You would then divide this figure by the total revenue to get your profit margin of 0.2. Finally, multiply this figure by 100 to get your profit margin percentage, which is 20 percent. Return on sales is one of the most important measurements in testing the logic behind your budget and sales strategies. It gauges the overall health of your business and shows how much of your sales revenue is actual profit versus operating costs.

What is in sales revenue?

The two main components of sales revenue are gross revenue and net revenue. Gross sales revenue includes the total amount of money a company receives from the sale of products or services. Net sales revenue subtracts sales returns, production costs, and other expenses from the gross sales revenue figure.

It can take time to build up a reputation and grow a strong customer base, so do not expect to see immediate results. You can and should have a plan in place as to how you will grow your revenue over time – this can include the introduction of new products, expansion to new markets, and more. Creating a pricing strategy is not a “one and done” process, but rather something that should be continuously revisited.

How to grow your business with Wise

Revenue is the money a company earns from the sale of its products and services. Cash flow is the net amount of cash being transferred into and out of a company. Revenue provides a measure of the effectiveness of a company’s sales and marketing, whereas cash flow is more of a liquidity indicator.

Net income, also known as the bottom line, is revenues minus expenses. Let’s take a look at where revenue and non-operating income are included on this multi-step income statement example from the U.S. ” However, offering discounts results in major benefits, like increased sales and customer loyalty. They also cut anticipated operational expenses by delaying the launch of a new initiative during the same quarter. This new company has hit the ground running and is the first true competitor to industry leader Cogswell’s Cogs. Sales have been outstanding, bringing in $500,000 in the first quarter.

The Sales Revenue Formula: How to Use It and Why It Matters

Under certain rules, revenue is recognized even if payment has not yet been received. For example, say online retailer Roosevelt’s Bears and Accessories sold 40 teddy bears in June for $25 a bear and collected $1,000 in receipts. It can only recognize revenue for those 20 bears, making recognized sales revenue for June $500 and the remaining $500 of unfulfilled orders gets recorded to deferred revenue. Then, subtract any depreciation and SG&A (selling, general, and administrative) expenses from gross profit to find the operating margin — also referred to as earnings before interest and taxes or EBIT. SG&A can include rent, utilities, marketing and advertising, salaries, and other operating costs. Calculating the return on sales ratio helps companies identify and determine the logic behind the overall sales strategy and budget.

- That can range from problems with quality, incorrect items, or longer than expected shipping times.

- For example, if you aren’t generating enough sales to secure a profit, you might need to adjust your sales approach or try another channel.

- In other words, you make 17 cents in profit for every dollar of sales.

- Investors often consider a company’s revenue and net income separately to determine the health of a business.

- However, for larger companies with more revenue sources, sales is considered only one source of revenue, particularly for businesses that have multiple investments and sources of revenue besides sales.

- While revenue is a gross amount focused just on the collection of proceeds, income or profit incorporate other aspects of a business that reports the net proceeds.

It is typically used to evaluate the effectiveness of a specific marketing or sales initiative. If Company Y can maintain revenues while reducing expenses, the company will be more efficient and, ultimately, more profitable. If, however, it isn’t possible to reduce expenses, they should keep their expenses the same while striving for higher revenue numbers. Instead, we recommend keeping your team motivated by having them focus on smaller, more obtainable goals that they can control like contacting “X” number of customers a day. Having your team focus on constant activity, instead of waiting to close a sale, is what will keep your sales process thriving and moving forward even if there’s a sales slump.