Little A mortgage Choice

Resource a tiny family in the united kingdom isn’t only regarding slashing zeroes regarding a traditional mortgage; it’s another type of economic journey using its own number of laws and regulations and you will possibilities.

Within guide, i cut-through the fresh economic fog, examining the diverse lending avenues off specialised unsecured loans to help you innovative peer-to-peer solutions tailored to that particular niche market.

We’re going to in addition to explore Uk-specific considerations for example property rules while the income tax land, facets that rather impression their investment approach.

So in case the small home desires cover a conservative sanctuary on tires or a rooted, eco-amicable build, this informative guide will be your total resource in making men and women aspirations financially attainable.

Smaller home mortgages

Regarding financing a little household, one option is as a result of home financing. Although not, getting a timeless financial having a small family might be difficult. Rather than simple homes, which have a multitude of home loan possibilities, little homes will belong to a grey area for of several lenders the help of its unconventional’ (hence we love) character.

Shortage of Equity

In a standard financial, the borrowed funds are secure resistant to the value of the house and this new homes they lies into the. Of many little homes manufactured for the rims or aren’t permanently affixed to land the homeowner possesses, making them quicker appropriate due to the fact guarantee for a financial loan.

Unconventional Assets

Little belongings usually cannot match the standard possessions classes you to mortgage loan providers are acclimatized to speaking about. That it unfamiliarity renders loan providers less prepared to offer a mortgage to own tiny home, because they will get perceive all of them as the greater risk. Especially if your home is on wheels.

Valuation Issues

Antique homes possess really-based metrics to possess valuation centered on rectangular footage, area, and other provides. Tiny residential property, however installment loans online in Washington, are so book that it is tend to difficult to get similar sales studies to ascertain a reasonable market value, complicating the loan underwriting processes.

Regulating Hurdles

Monetary statutes are install having old-fashioned land in mind, and you may small belongings may not satisfy every standards set forth because of the regulatory government, making it difficult to secure an elementary home loan.

Less Lifespan

Some smaller belongings, instance those individuals maybe not made to basic strengthening requirements, have a shorter expected lifetime compared to the antique house. Lenders could see this since a threat, while the property-serving once the guarantee to the mortgage-will get depreciate more easily.

Smaller Mortgage Numbers

The fresh seemingly discount out-of smaller belongings as compared to antique property could be a deterrent to have mortgage lenders, given that smaller loan wide variety is almost certainly not given that winning.

Lightweight domestic Unsecured loans

If antique home loan route demonstrates also difficult otherwise restrictive having money a tiny family, unsecured loans appear since the a well-known option. Rather than mortgage loans, unsecured loans is unsecured, meaning they don’t wanted equity, which makes the applying procedure quicker complex. However, so it liberty boasts its number of challenges and you will will set you back.

Advantages of Personal loans

- Easier Acceptance Techniques: Unsecured loans normally have a quicker, easier approval procedure versus mortgage loans. You’re not locked with the by using the mortgage to own a particular mission, getting freedom in how you allocate the income.

- Zero Collateral Needed: Mainly because financing try unsecured, you don’t need to use your little household and other resource while the equity, that will be useful if you are not but really certain concerning your long-name preparations toward household.

- Fixed Payment Plan: Signature loans typically have a fixed rate of interest and a defined repayment months, providing predictable monthly obligations.

Drawbacks from Personal loans

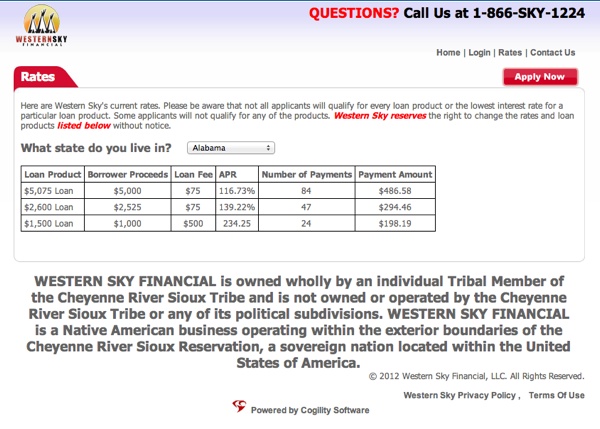

- High Rates: The eye cost for personal financing are greater than home loan costs just like the lender was taking on more chance because of the not demanding guarantee. Along side financing term, this can substantially help the total cost of tiny domestic.