To see how much you can easily pay four weeks, multiply the brand new each and every day rates of the level of weeks in your billing years. For those who have good twenty-seven-time battery charging period, proliferate 0.55 because of the twenty seven. For the a great $step one,000 balance which have a great 20% Apr, possible spend $ from inside the attract month-to-month.

Kind of Apr

Their mastercard can charge a special ple, some playing cards enjoys a separate Apr to have transfers of balance, which may be high otherwise lower than the standard Annual percentage rate. The new Apr toward cash advances is commonly much more greater than having fundamental card requests. For folks who spend later or otherwise violate brand new regards to their cards arrangement, you may need to pay a punishment Annual percentage rate.

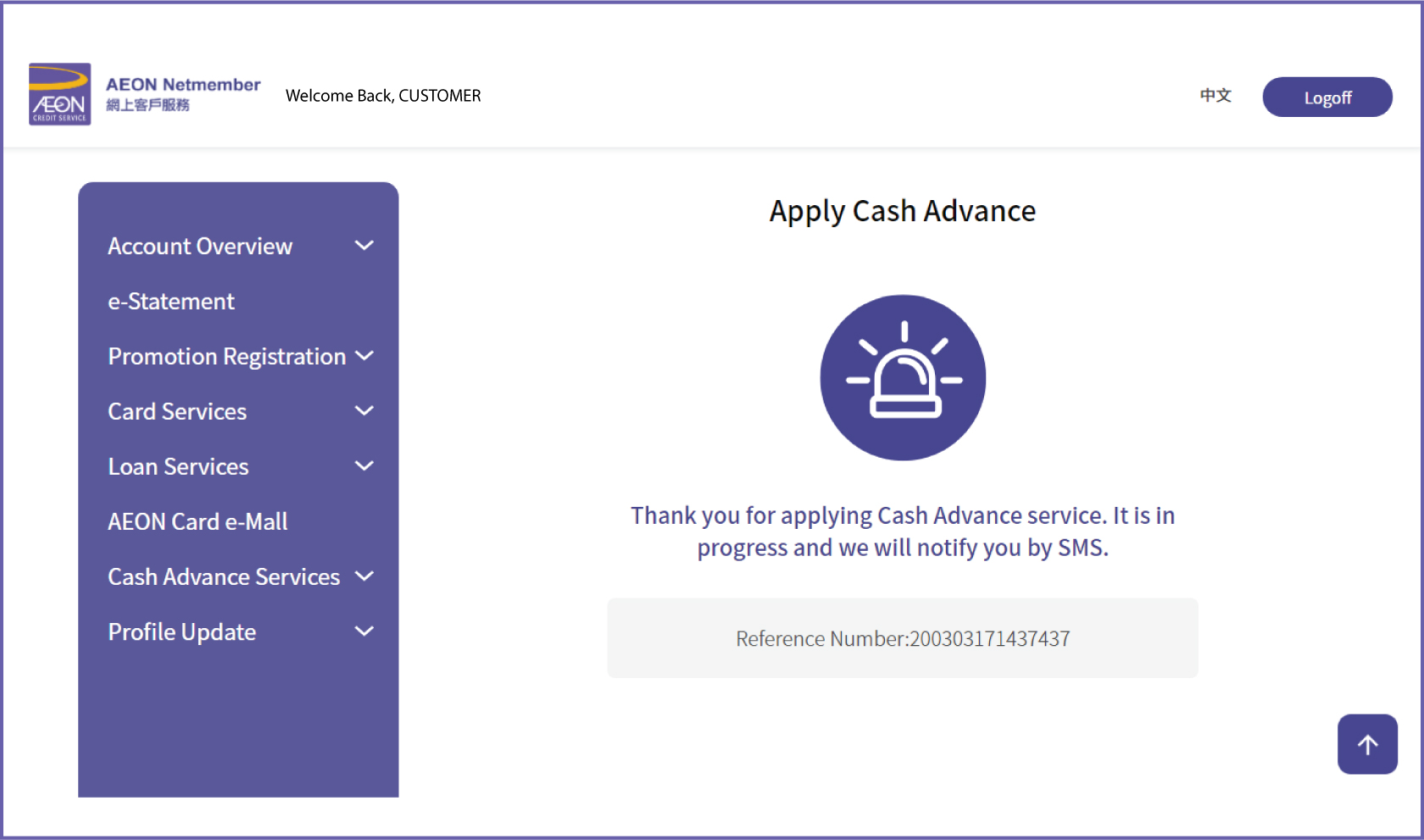

If you utilize your own credit card to find bucks, possible normally pay an alternate, large Annual percentage rate that doesn’t enjoys a sophistication months.

You could transfer an equilibrium from one card to some other. If you do, you are able to constantly pay a new ount. Some cards bring a diminished Apr having balance transfers in order to draw in you to switch.

Handmade cards either render an advertising otherwise basic Annual percentage rate, such as for instance 0%, in order to remind that open another type of membership. The marketing rates get affect the brand new orders to the basic several months or 12 months that you have the brand new cards.

For those who shell out later or miss several money, their card company can charge you a penalty Annual percentage rate, which is often a lot higher than the pick Annual percentage rate. (Starting repeated monthly premiums otherwise commission alert reminders may help you avoid late money.)

Take a look at click here for more small print directly whenever joining good the fresh new charge card. The latest cards give will include a table which have cost and fees which make it obvious their Apr.

Annual percentage rate versus. APY

If you’re Annual percentage rate is when far you borrowed into a balance, yearly percentage yield (APY) identifies simply how much an interest-bearing membership, such as a checking account, can also be secure annual.

APY is additionally expressed while the a portion and you may has the attention speed towards a free account, together with how frequently desire substances toward account. As you want an apr is as little as you can, you desire an enthusiastic APY to get as much as you can, because it makes it possible to generate income.

Creditors typically give best costs to the people that have higher fico scores. Make repayments on time and avoid beginning several levels at once to keep your get popular up. While you are about to the people credit cards otherwise loans, rating current in your costs to increase the score.

Card organizations sometimes give advertisements equilibrium import APRs to help you prompt someone to start the notes. For people who bring an equilibrium towards the a card with high Annual percentage rate, it may be convenient to open a balance transfer card and you will gain benefit from the all the way down speed.

You should never bring a balance Without having an equilibrium towards the credit card, you will not pay focus. Maybe not holding an equilibrium would not lower the Apr in itself, nevertheless will reduce simply how much you pay.

The conclusion with the Apr

Just like any economic agreement, get acquainted with the borrowing card’s fine print, plus their APRs. Keep in mind that Annual percentage rate is applied when you’re carrying an excellent balance on your credit. You could potentially normally stop spending people notice charges if you pay out-of your own card harmony up until the statement months ends monthly.

Selecting the most appropriate charge card shouldn’t be difficult. Learn about all our bank card selection and just how we have been ready so you can reach finally your money wants. If or not we wish to make money straight back perks or import a great balance, find the cards that can match your existence and requires.

- Proliferate the newest everyday price by the balance you borrowed from: 0.0548% x step 1,000. You’re going to get 0.548, or just around 55 dollars just about every day.