Whilst the mediocre CTOS credit history when you look at the Malaysia has increased so you’re able to 678 (Classified just like the Fair), many however struggle with worst creditworthiness. Centered on an effective Monash College Malaysia and CTOS study , 49.5% of your Malaysian inhabitants provides relatively reasonable fico scores. Also, an identical search in addition to unearthed that increased paying one of several more youthful generations try a contributing foundation to that procedure. Therefore, focusing on how credit ratings works and you can understanding how to boost them is important to stop too-much obligations. Let us see all about it in this article!

What is a credit rating?

A credit history are lots, that lenders use to influence their creditworthiness centered on your financial history. Into the Malaysia, so it rating usually selections between 3 hundred in order to 850. The higher your own get, the more likely you may be viewed as a reliable debtor.

How can i Have a look at My personal Credit score?

CCRIS (Main Borrowing Source Advice System), addressed from the Bank Negara Malaysia, provides a detailed credit history however, cannot assign a particular rating. While doing so, CTOS is a private credit scoring service that give a mathematical score anywhere between 300 so you’re able to 850, and therefore simplifies assessing the creditworthiness. Both systems are essential equipment to possess loan providers to test your financial patterns and you can records?.

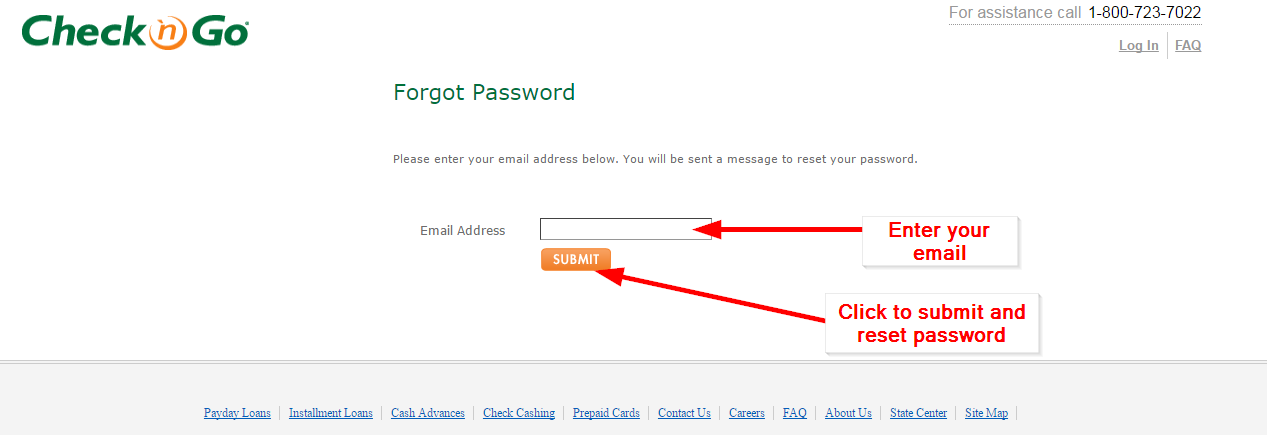

Examining your credit score into the Malaysia is not difficult, you can visit one of these institutions’ websites: CTOS , otherwise CCRIS , create an account and request your credit history of the completing an on-line form.

Advantages and Uses regarding Fico scores

Your credit score isn’t only several – it performs a serious part from inside the unlocking individuals financial opportunities. Here is how a good credit score may benefit you:

1. Easier and Smaller Financing Recognition

Financial institutions and you may creditors within the Malaysia prefer lending to individuals having large credit ratings to reduce the risk of late money and you can defaults. Such as for instance, for people who score 750 or more than, financial institutions tend to be more planning approve your home otherwise automobile loan application faster. At the same time, should your get was lowest, you can face waits or even rejection.

dos. Down Interest rates

Aside from faster recognition, loan providers provide best prices to individuals that have good credit once the they look at them because the less risky. For-instance, while applying for an unsecured loan when you look at the Malaysia as well as your credit history try over 800, you will get a diminished rate of interest than people having a beneficial score off 600. Therefore, you can spend reduced within the appeal along side lifetime of the loan, saving you profit the future.

step three. Access to Best Selling

Apart from funds, a top credit history will give you use of top sale to your financial products. Credit card issuers, for-instance, commonly bring premium notes with additional personal masters, such as perks, cashback, and you may traveling benefits, to the people with a high credit scores. More over, specific insurance companies in Malaysia have a peek at the hyperlink think about your credit score whenever choosing your own premiums. Basically, the greater your rating, the greater the brand new marketing you will likely located.

Situations You to definitely Influence Fico scores during the Malaysia

Numerous items is also influence your credit rating inside Malaysia. Skills these products makes it possible to manage your credit more effectively:

- Payment records: This indicates your reputation purchasing bills, loans, and bank card stability punctually. Actually one missed payment normally adversely apply at their rating. Such as for instance, if you constantly spend your car financing late, it will end up in your credit score to decrease, so it is much harder so you’re able to safe upcoming money.

- Sum of money owed: Your credit rating are going to be all the way down when you have several maxed-away handmade cards. To evolve the rating, it’s necessary to manage your debts sensibly and maintain the borrowing from the bank cards balances lower than 31% of the total credit limit.

- duration of credit score: An extended reputation of responsible borrowing from the bank usually means increased credit score as it gets loan providers much more information regarding the credit behaviour. Maintaining a lengthy history of in control borrowing from the bank usage works well

- Particular borrowing from the bank owed: A mixture of borrowing from the bank models-such home financing, car finance, and you can credit cards-can be definitely perception your credit rating. Loan providers like to see as you are able to do different varieties of credit responsibly.

- The borrowing accounts: Opening numerous the new credit levels inside the a short span is negatively apply to your credit score because it you will imply that you take toward excessive obligations too-soon.

Fico scores into the Malaysia surpass the three digits you see online; they have been an important element of debt lifestyle. Of the understanding just what impacts the rating, you could take steps to improve they and you may safer greatest solutions. Important tips like setting-up position recommendations to have money and you will spending from large-notice costs can help improve your score. Very, always keep track of your own get and you can prioritise timely costs getting debt wellness!