The income getting a deposit is talented, and review trail to help with the present is relatively effortless. Just make sure to check on together with your tax seller into the ramifications out-of gifting a down payment.

And here old-fashioned software will be simpler. Due to the investigation available, discover usually assessment waivers otherwise waivers useful supplied by DU otherwise LP.

FHA Mortgage loans

FHA means Government Homes Government. The objective will be to promote homeownership. The underlying goal is not and then make an income, nonetheless in addition to don’t work as too big out of a loss of installment loans online Michigan profits. FHA mortgages can be more expensive with respect to high notice rates because of granting those with below average borrowing.

FHA mortgage loans require more administrative red tape. For each and every application gets an FHA circumstances amount, an effective CAIVRS report, and a finite Denial regarding Involvement (LDP) / General Safeguards Agreement (GSA), all obtained from the FHA commitment. Having borrowers exactly who can’t clear one of these account, a great deal more work is required into financial software.

FHA mortgages have financing restriction according to the Urban Mathematical City (MSA). As the mission are homeownership, FHA will not help a rich people purchase its luxury family.

Credit:

In general, a borrower need to be a lot more than 600 and also have zero biggest later repayments in the last 12 months. Bankruptcies should be more 2 yrs dated, and property foreclosure must be greater than 3 years.

Capacity:

Income try determined, and requirements are like antique. Earnings should be stable on previous 24 months and seeking give. The work time may include complete-big date college student so long as the latest work is in this field out of research.

The fresh calculation of the front and back-end ratios matches conventional. Your debt-to-income underwriting fundamental having FHA financing approvals could have been 29%-43%. However, i aren’t find approvals that have an ago-avoid proportion more than 50%.

Resource

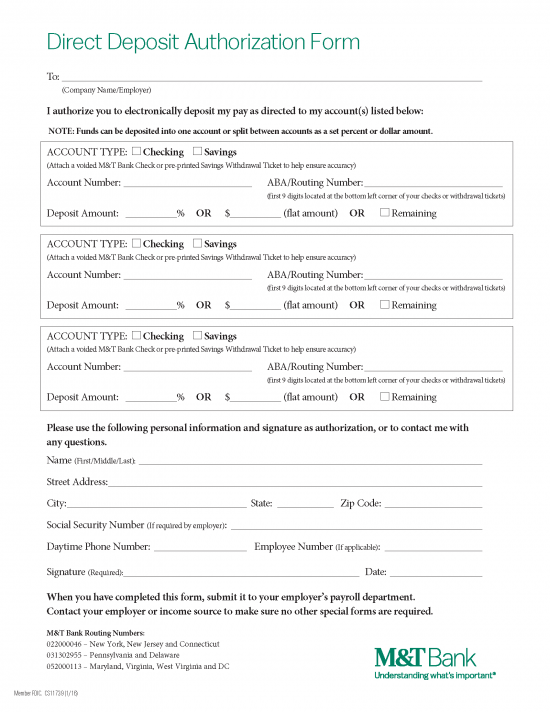

A keen FHA mortgage keeps low-down commission criteria. They approve an acquisition of a house which have only a step 3.5% down-payment. The income towards the advance payment are going to be talented, nevertheless review trail to support the brand new provide is far more challenging than just into a conventional mortgage. To possess FHA money, the donor must fill out proof capacity to donate the cash. Very, to put it differently, if the The parents try gifting their down payment, we have to come across the bank comments.

Such as for example conventional, money in the way of a down-payment otherwise discounts try good compensating factorpensating things accommodate highest obligations-to-earnings rates as recognized. FHA together with makes it possible for six% seller concessions to fund a customer’s closing costs and you can prepaids. It is more conventional with many people. With a debtor that has a finite sum of money in order to put down, the additional concessions help get some requests finalized.

Collateral:

FHA demands the full appraisal on the lots of software, apart from an FHA improve. An assessment signing program along with has actually suggestions from earlier thinking and you can information. An FHA assessment is actually a far more in-breadth appraisal than just an entire old-fashioned appraisal. The new appraisal logging system features details out-of details, reasonable or unjust, that would more products.

Area of the part of difference between the cost of FHA and you can Conventional finance is actually Mortgage Insurance costs. FHA costs an initial Home loan Insurance premium (MIP) generally speaking step one.75% of amount borrowed long lasting downpayment percentage. This will be paid back initial otherwise put into the loan harmony. FHA and fees an extra annual commission generally put in your own payment. Which insurance rates fee would-be into lifetime of the mortgage if you don’t place ten% down. Old-fashioned money simply need borrowers to invest Individual Mortgage Insurance policies (PMI) if the its deposit is less than 20%.