Sorry for those questions when i discovered the website to the a Query and i also know I’m not a banker, but my partner and i are stressed from whole process of shopping for our very own first house. Allow me to explain my situation.

New underwriter’s office failed to assign a different underwriter to cope with our circumstances up to Wednesday (3/13) together with this new underwriter don’t tell our loan officer all additional files (that he need, nevertheless the prior underwriter didn’t need) we needed up until Thursday (3/14)

Our home closure was said to be past (3/18) and Lender out-of America cannot even give us an up-to-date imagine whenever an underwriter is about to feedback our very own file. An underwriter was initially assigned to our instance weeks hence and you may past Friday (3/11) she are designed to talk about the document to help you agree it, but called for the unwell. Any of these freshly asked files was in fact, genuinely, ridiculous and all of our financing officer happened to be taking mad and had so you can “fight” your to locate him https://paydayloanalabama.com/joppa/ to drop a few of the conditions.

For example, among the many anything he was asking for is a letter off reason of it “recurring” charge another month over the past two months if in case it was an additional responsibility to enable them to worry about. One repeated charges is actually a pizza pie spot for which we’d bought on the web of appear to as 5 people in my wife’s household members had come going to out-of overseas and you will desired restaurants taken to their AirBnB nearby in addition they failed to get money on delivery for these requests (their family paid back us in cash alternatively). The mortgage administrator did not even query united states towards page any longer and just delivered the latest underwriter a yahoo charts picture and you may place of pizza invest question.

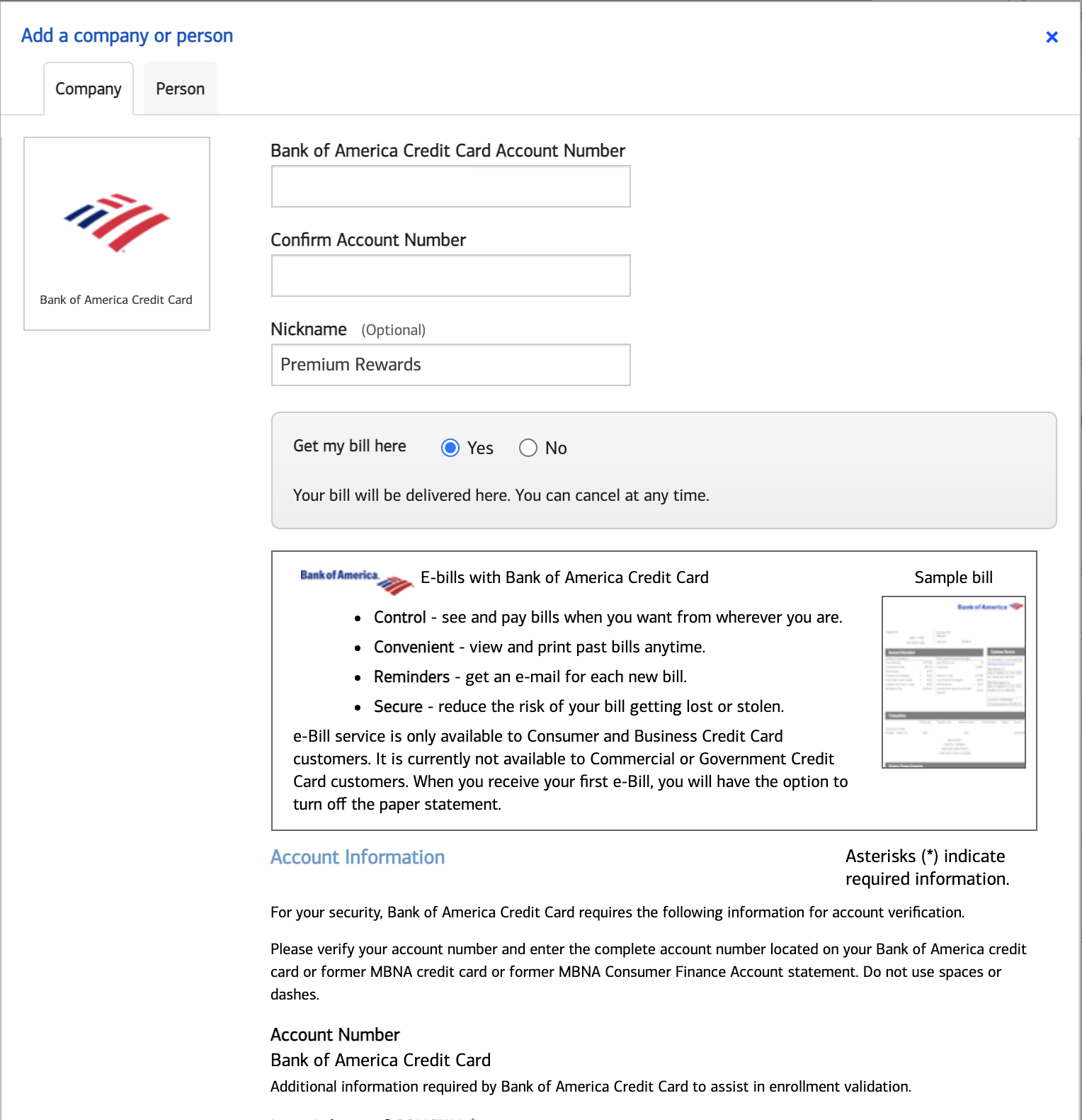

One to brings us to our most other situation about your closure revelation. Both of us received a contact at around 243am toward Saturday (3/18) day, the arranged big date of our own domestic closing, that the Closure Disclosure was available today to review and you may accept thru their on line banking’s “Home loan Navigator.” (Didn’t so it have to be given 3 days in advance of the closure? Exactly why are they only taking it to all of us at the time out-of closing?) In any event, I logged on to my personal online membership you to definitely morning, but I can not availableness the fresh closing revelation as I am not the latest no. 1 borrower (my partner is actually) and you can she needs to alter a setting to make it on the web seeing. And so i provides my spouse join plus it ended up being that we pointed out that she doesn’t have usage of the newest mortgage navigator after all. Appear to when setting up all of our on the web financial accounts years back, their SSN is never ever set in they.

Very seem to they composed a special “dummy” membership for just her SSN therefore the home loan navigator, however with no way for us so you’re able to log in because of devoid of a good login name or password (in addition to on line code data recovery and additionally offers a mistake of trying to recuperate these details, presumably because they do not are present). I named support service right away as well as said that i has one or two solutions: 1) create a unique online financial acccount just to accessibility the home financing navigator with her SSN otherwise 2) head to an excellent BofA financial cardio getting good banker add the SSN to their particular most recent online bank account.

We experimented with the original solution, because it try suggested of the technology support it is smaller, but immediately following starting said membership – there is certainly a 3-5 big date waiting period up until the code was shipped so you can you. On viewing it, i instantaneously head to brand new nearby part. The fresh new banker who was simply assisting all of us are having issues with trying to to add the SSN whilst believes that the account for one to SSN already exists. Her manager turns out assisting all of us, however, every he might carry out was file a consult with their tech support to get the accounts matched (which will take 48 hours).

So now right here our company is. Suppliers are willing to expand, but just up until it Saturday (3/22). We haven’t received an ending revelation yet, so that the soonest we could personal is a little while very early next week. Sellers try threatening to get aside whenever we cannot close this Friday because they has content even offers and will come to be delivering all of our $10,000 earnest money deposit together with them. The condominium lease arrangement as well as ends up second Weekend (3/31) therefore we won’t have a destination to real time following that into the, given that our landlords have previously discover a different occupant.

As of now, as far as i know (all of our financing officer has not been pretty good in the remaining all of us updated) i still have not got an underwriter remark the situation

Immediately following talking with product sales director employer your loan officer today, she stated that sellers usually do not crack this new bargain because the contracts succeed an extension into the step three big date waiting period delay out of a great closing disclosure. I simply looked at our very own package just now and it also says little of your sort, merely a good 4 go out extension if terms of the borrowed funds possess altered. Try our very own condition some thing we could waive the 3 go out wishing months for the making sure that we can intimate that it Monday?

It very well be BofA’s fault, but it’s a very good exemplory instance of why you need to not buy a property as opposed to enjoyable your own attorneys on the techniques. Talking about purchases that most people run possibly a couple of minutes within life and usually many years aside. Listening to the fresh seller’s real estate professional and/or lender, who do not handle your case, cannot make you much to go on. Needed the earnings and can, and usually will, show some thing.

I might feel amazed when the BofA is going to enable you to help you waive the three days, while they would state you to definitely bad thought isnt a financial crisis in addition to only individual the financial institution throws on the line of the making it possible for an excellent waiver is by themselves.

While we all feels your outrage, that’s always the danger when you’re which have a large conglomerate instead of a district establishment where you are able to in fact stroll in to discover people in your own exchange. If your closing is actually suppose are no afterwards than simply step 3/18 and it was not gonna underwriting up until 3/11 – better that actually leaves little or no step room.

Your failed to inform us once you in the first place removed the brand new loan, however, to quit the majority of so it, individuals purchasing a house will often have the capital installed and operating before they sign a buy deal except that dotting this new i’s and you will crossing the brand new t’s once they find the possessions that they wanted.